Source: Thinkstock

1. You will likely need – not want – to retire one day

You’re young, invincible, and ready to conquer the world. Why on earth would retirement be in your newsfeed? Because research shows one day you will retire – maybe sooner than you think. Despite the dismal retirement statistics on how little money Americans have saved for their so-called golden years, Gallup finds the average retirement age is 62. This corresponds with the Center for Retirement Research at Boston’s research that finds the average retirement age is about 64 for men and 62 for women.Delaying retirement to compensate for a lack of savings is a risky strategy currently in use. A third of older workers believe they will never retire and will work until they die or are too sick to work. Yet good health and job security are no guarantee, especially in your later years. The “need to retire” often becomes reality. According to a study from Bank of America Merrill Lynch, 55% of retirees actually retired earlier than expected. Unfortunately, health problems was the number one reason for doing so, followed by job loss.

True, medical advancements are pushing life expectations to new frontiers, but that means decades of retirement time for you to fund. While you’re grandfather enjoyed a company pension, and his father simply died of old age at a meager 50-something, you’ll need to build your own nest egg and watch over it until you’re 80, 90, or even 100.

2. You are a unique snowflake on a slippery slope

Yes, millennials are unique snowflakes, but not in a good way. A survey from Charles Schwab finds millennials, more than any other group, may not be saving enough for their future selves. The millennial reputation of being entitled surfaces. Forty-four percent are not saving more for retirement because they are unwilling to sacrifice things that add to their current quality of life. Instead, they want to treat themselves to instant gratification like dinners out and vacations. That’s compared to 34% of Gen Xers and 29% of baby boomers who say the same.The educational system is also partly to blame. Schools don’t spend nearly enough time teaching kids about personal finance. Young adults then head to college and find themselves saddled with unprecedented amounts of student debt upon graduation. More than a third of survey respondents say they can’t set aside more money for retirement because they are still paying off student loans. About half of millennials feel they don’t even know what their best investment options are, and only a third are extremely or very confident in their abilities to make the best 401(k) investment decisions on their own.

The average 2015 graduate will enter the real world with about $35,000 in student debt – the most indebted class to date. That may not sound too terrible given the earnings potential if you choose your degree wisely, but this average has increased on a regular basis for over 20 years. Debt loads of $100,000 are not unheard of, rising education costs exceed most other inflation rates, and student loan debt is the second largest household debt burden in America at $1.2 trillion, only behind mortgage debt. The default rate on student loans is by far the worst at 11.5% – a rate the Federal Reserve admits is likely understated due to deferment, grace periods, and forbearance conditions.

3. Procrastination only makes it worse

Source: JPMorgan

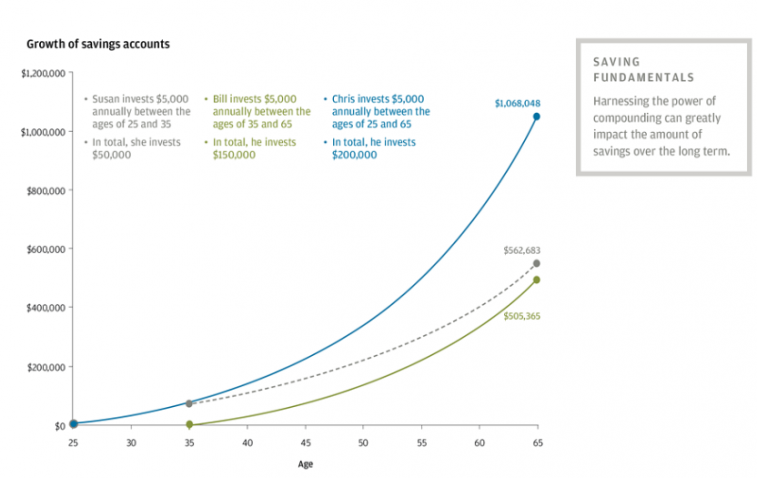

As the chart above shows, a person who invests $5,000 annually between the ages of 25 and 35 will have an estimated $563,000 at age 65, assuming a 7% annual return. By comparison, a person who invests $5,000 between the ages of 35 and 65 will have about $58,000 less. This is a prime example why you keep hearing to start saving as soon as possible.

Market returns are not guaranteed and are certainly more volatile than 7% each year, but the math displays the benefits of compounding returns. The earlier you start, the better your chances of reaching your life goals. Your chances also improve if you start early and keep a consistent pace. A person who invests $5,000 annually between the ages of 25 and 65 could accumulate more than $1 million for retirement. The caveat: you need to take action, nobody is going to do it for you unless you think Social Security will fund your entire retirement.

Culled from money cheatsheet

No comments:

Post a Comment